Lets say youll be investing a sum of money in an investment plan for the next 20 years.

The plan says that youll get a return every quarter.

The higher the IRR more lucrative the investment plan.

Contents

What Is the Internal Rate of Return (IRR)?

Then pick the one that gives the maximum IRR among all the options.

Also read:Best Excel Budget Templates

What Are the IRR Functions in Microsoft Excel?

Excel has three dedicated internal rate of return calculation functions.

Learn about these functions here:

1.

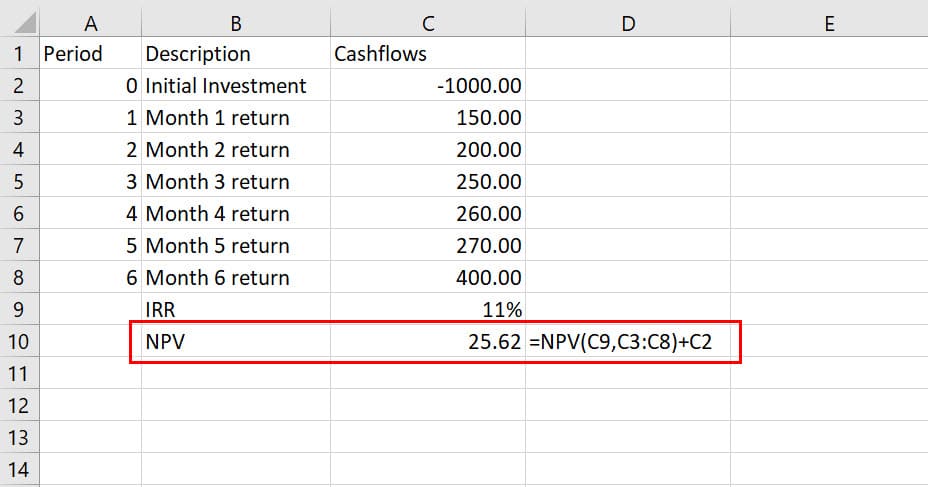

The investment must include at least one positive and negative value.

Also, the cash flow into the fund should occur at regular intervals.

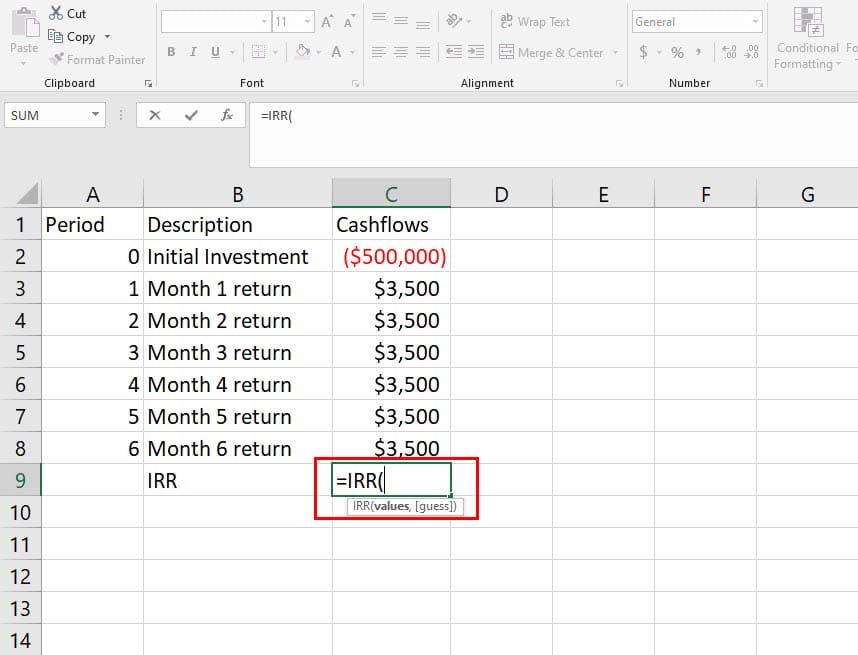

Heres how the formula looks:

2.

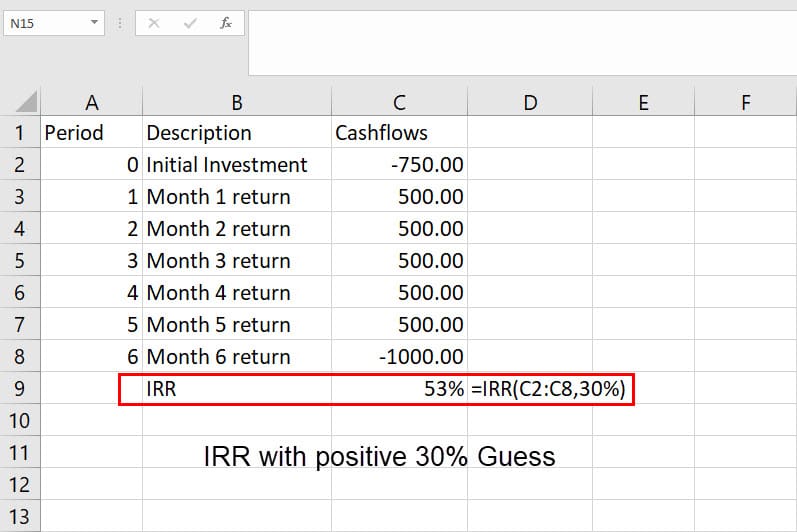

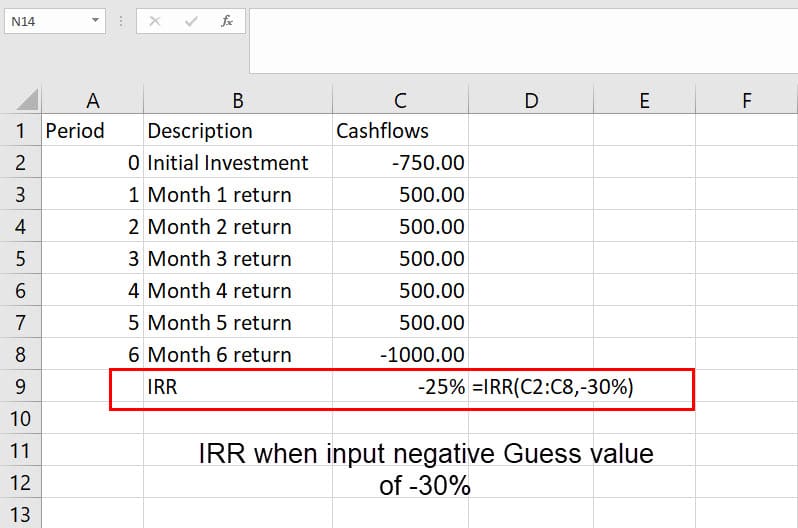

The syntax is as below:

3.

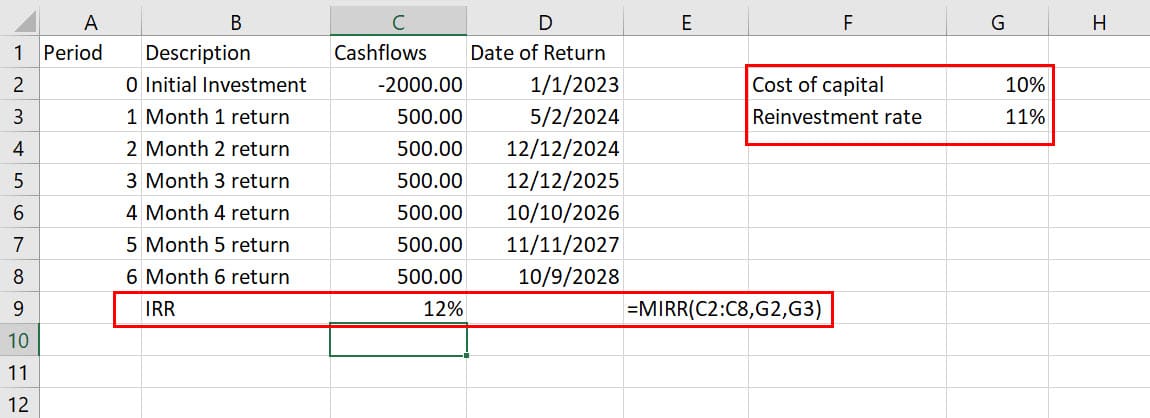

MIRR for Reinvestment of Project Funds

MIRR gives highly reliable IRR values as compared to the simple IRR function.

IRR doesnt consider the cost of capital that you invest.

Hence, the final value of IRR isnt accurate.

Lets say youre looking for a 12% return.

In this scenario, you must use the XIRR syntax.

Here, it’s possible for you to include two mandatory factors: cost of capital and reinvestment rate.

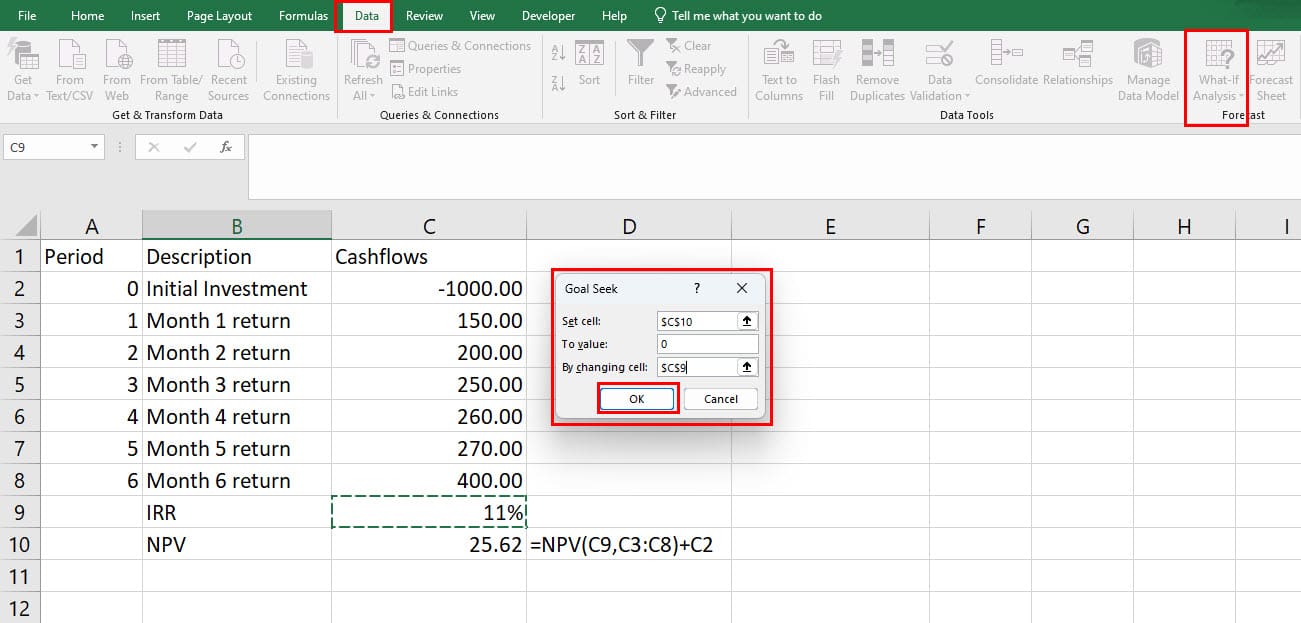

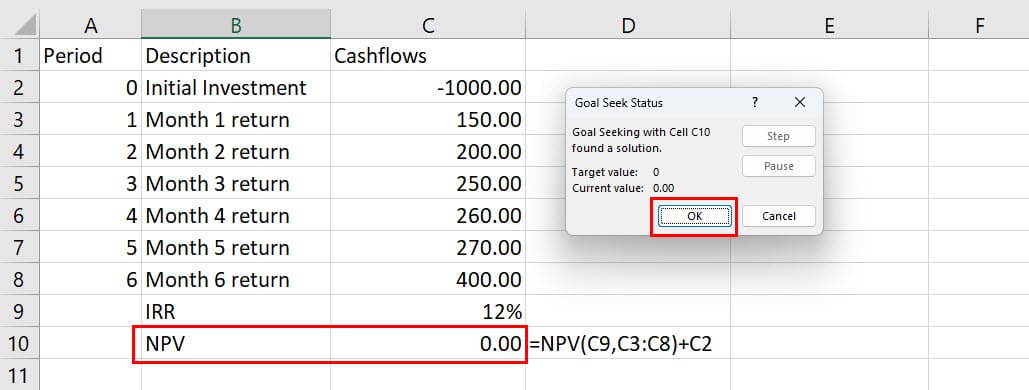

If you need greater accuracy than this, you might use the Excel Goal Seek function to calculate IRR.

In this method, Excel performs up to 32,000 iterative calculations before generating a return value.

Also, you learned how to use Excel Goal Seek to calculate IRR in Excel.

If I missed any other method, dont forget to mention that in the comment box below.

Next up,how to use Excel IF-THEN formula.