Do you need help in covering emergency spending or a discounted shopping opportunity that you dont want to miss?

you could use any of these cash advance apps like Dave.

Its convenient and easy to borrow small amounts of money from apps like Dave.

These are cash advance apps and have been growing in numbers lately.

Such apps also dont usually make a hard credit pull which is good for your credit health.

Market experts consider that Dave is possibly the first cash advance app to lend small cash loans.

However, with its popularity, it made cash advances tough to get.

There are many other reliable and consistent cash advance apps in Google Play and App Store.

Its available for iPhone and Android mobile phones.

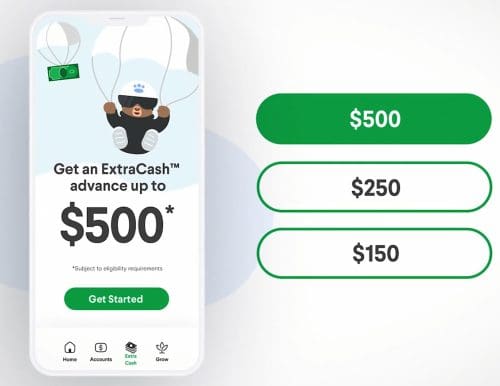

However, it doesnt offer everyone a $500 cash advance.

It depends on your financial profile and your capability to settle such small loans in time.

Though the app says that it doesnt charge you any late fees.

Its notable features are as follows:

Seems pretty appealing to be a cash advance app.

But hold on now!

Find below some challenges with Dave as a cash advance app:

Love to use Apple Pay?

For the above reasons, you may want to explore other options that offer more borrower-friendly features than Dave.

To help you, Ive handpicked some cash advance apps like Dave by evaluating their features and functionalities.

These are outlined below:

1.

Its also an instant cash advance app like Dave.

Its notable features are as outlined here:

It charges you $9.99 monthly as a subscription cost.

Download Brigit onGoogle PlayorApp Store

2.

However, the employer needs to participate in the PayActiv program as well.

It may seem like a complex cash advance app.

However, if your employer is helpful, then the app works just like any other cash advance app.

Get PayActiv for mobile phones onGoogle PlayorApp Store

3.

Branch: No Wait Pay

Branch also offers cash advances like Dave.

Get Branch onGoogle PlayorApp Store

4.

You get money earlier than the payday from the payroll that your employers manage on the Even app.

Employers can also provide various employee benefits using this app.

Its a great alternative to Dave app.

Here, youre not borrowing money from a lender and making a habit of it.

The app also offers you a better interest rate if you keep your paycheck money in your Even account.

However, for cash advances, it charges 0.125% APY.

Download Even onGoogle PlayorApp Store

5.

If you love to do everything on your mobile including banking, youll also love the SoFi app.

However, your employer must pay your wages, tips, and employee benefits via this app.

This is a safe option than Dave because it doesnt let you grow money-borrowing habits.

Get SoFi for smartphones onGoogle PlayorApp Store

6.

EarnIn: Your Money in Advance

Earning offers cash advances like Dave in two forms.

One way is $100/day on the grounds of your good financial record with the existing bank.

It collects the settlement amount from your bank account when the paycheck gets deposited.

Also, it charges you a fee but the lender calls it a Tip.

Download and install EarnIn fromGoogle PlayorApp Store

7.

Download Chime fromGoogle PlayorApp Store

8. you’re able to replay it when the paycheck is deposited by the employer in your bank account.

According to Albert, there are no interests, APY, APR, hidden charges, etc.

Get Albert fromGoogle PlayorApp Store

9.

MoneyLion: Go-to Money App

MoneyLion is a comprehensive finance and money management app.

It functions as your credit builder, finances tracker, and mobile banking app.

Also, it has the standard advance paycheck option for up to two days before the actual payday.

Get MoneyLion onGoogle PlayorApp Store

10.

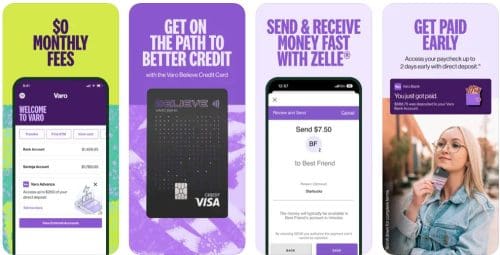

It has multiple benefits for you if you love digital finances.

However, there is a complex money-making business that these cash advance apps are doing.

Some other apps like Dave simply ask you to pay a subscription fee, tip, and so on.

In those cases, give the above cash advance apps like Dave a try.

However, dont forget to check out thesemoney making apps for smartphones.